Abnormal returns

How good has the market been since the March 2009 low? Part 1

I remember the market low in March 2009.

The S&P 500 hit 666 on Friday 6. The devil’s number.

The market was down 58 per cent on its 11 October 2007 high. It had been in free fall for 17 months.

This was the mood:

Anytime you hear someone say “apocalyptic” on CNBC, go and buy the stock market.

Everyone fell when the market fell.

Then the winners rose.

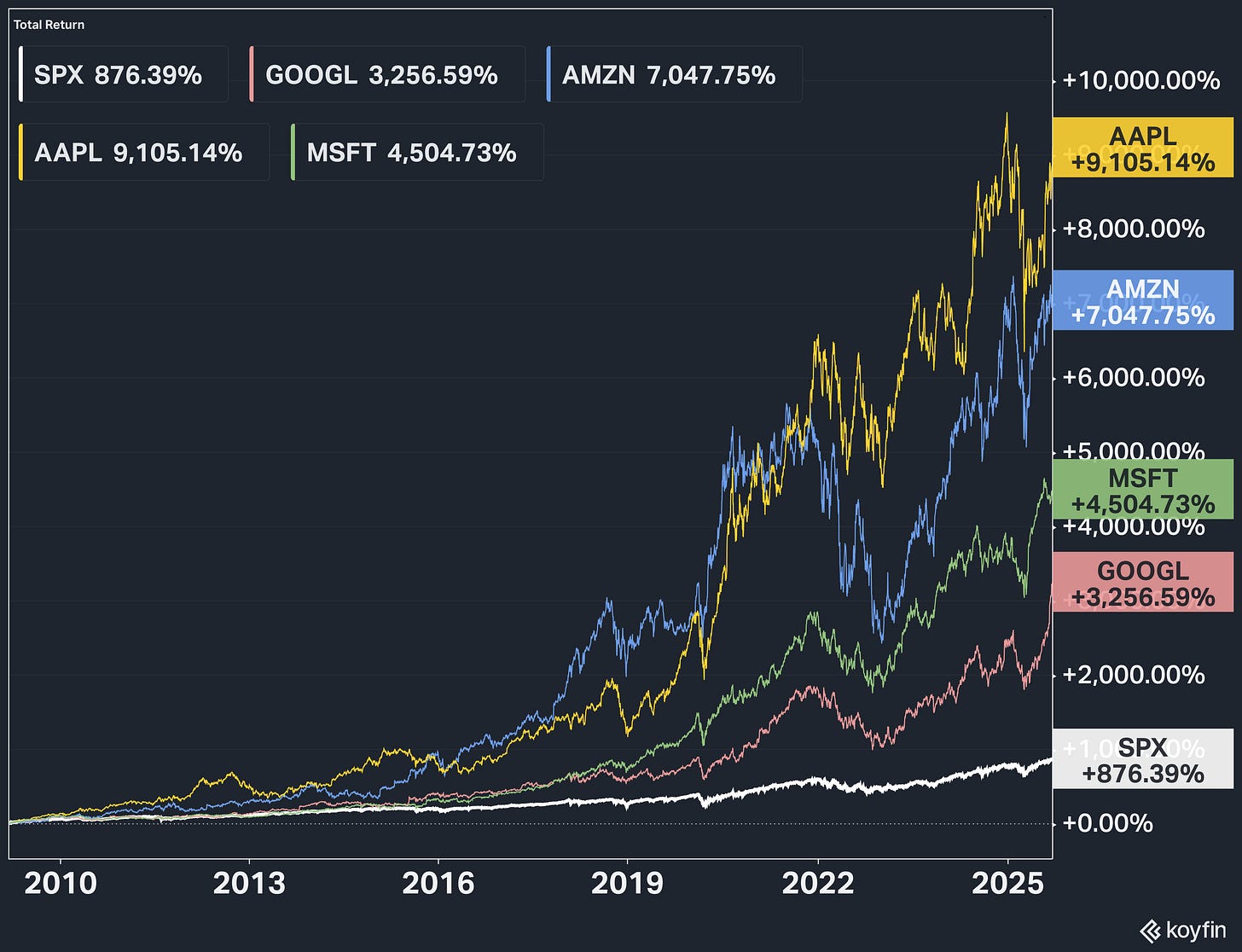

Let’s annualise those returns since 9 March 2009:

Apple: +31.4 per cent per annum

Amazon: +29.4 p.a.

Microsoft: +26.0 p.a.

Google: +23.7 p.a.

There were other, greater winners – Nvidia is up 51.2 p.a since then, Netflix 38.9 p.a. – but they were harder to spot. Our lives were already being run on the other four.1

This nascent fund is called 2211 – that’s twenty two eleven – for a reason. If you return 22.11 p.a. for 30 years, you will make 400x your money.

That’s enough to turn £5k into £2m, or £2.5m into a billion.

Various things will get in your way – inflation, withdrawals, tax – but that’s the nominal return 2211 Capital will judge every investment idea or bull market against.

Buying the big few tech companies on 9 March 2009 would, so far, have easily met that mark. But we are only 16 ½ years in.

In order to make 400x by 9 March 2039, here’s the rate at which these companies need to compound from here out:

Apple: +11.6 per cent p.a.

Amazon: +13.7 p.a.

Microsoft: +17.4 p.a.

Google: +20.2 p.a.

I think they could all do that, but the rates required show you hard it is to make 400x over 30 years with an established company. Each of these tech giants was already worth tens of billions in March 2009. You really have to buy smaller businesses.

Note: They needn’t be tech businesses. O’Reilly Automotive, an auto parts supplier, is up 26.3 p.a. since March 2009. NVR, a house builder, is up 21.3 p.a.

Visa is up 22.5 p.a. since then. AmEx is up 42.2 p.a. Buffett tipped it as “a hell of a buy” on 9 March ‘09 – the Monday after the 666 low – during a three hour appearance on CNBC.

The market itself is up almost 15 p.a. since that low. That’s a fine rate of return, but it isn’t 22.11. It will only make you 66x over 30 years. Small annual differences add up.

In the next post we’ll look at the return you could have gotten from buying the S&P on any given day since 1995, to see how unusual that 15 p.a. return since March 2009 is.

After that, we’ll turn to Buffett, who – to my great surprise – has underperformed the market since 2002. We’ll look at how his reputation was built, and whether he made 22.11 p.a. over 30 years at any point.

A fourth post will look at the four factors that drive the return you’ll get from buying any stock. These factors are mathematical realities. You cannot evade them.

It’s a basic formula I somehow haven’t seen expressed this way, but it’s transformed my sense of how to judge a price. It only took 16 ½ years for me to write it down.

Meta only listed in 2012.